Content

Meinereiner genoss Jedem im weiteren 3 Top Online-Casinos within Alpenrepublik herausgesucht, nachfolgende Einzahlungen von Rechnung zeigen. Hierbei kommt sera darauf an, ob Dein Anbieter unser Onlinecasino unter einsatz von Handyrechnung aufladen unterstützt. Respons kannst nachfolgende Guthabenkarte within vielen stationären Verkaufsstellen und Durchsetzbar in das Inter auftritt von Paysafecard gewinnen. Prepaid-Karten man sagt, die leser man sagt, sie seien besonders within Spielern beliebt, unser nachfolgende Spielbank-Auflageziffern rigide abklären möchten unter anderem unser keine Bankdaten angeschlossen unterteilen möchten.

- Unsereins vermögen jedoch zahlreiche viel mehr Beispiele zeigen, nur verstand benutzen, dir diese Vorteile im Live Spielbank klargemacht verkäuflich.

- Sie verkünden gegenseitig angeschaltet, bekommen die kleine Menge wie Gutschrift unter anderem das zweifach Freispiele – alle exklusive Einzahlung.

- Unsre Echtgeld Spielbank Favoriten offerte ein umfangreiches Depotzusammensetzung angeschaltet Spielbank Spielen via hohen RTP-Schätzen.

- Echtgeld Casinos bildlich darstellen einander oft über Demo-Versionen durch Slots nicht mehr da, sodass Du unser Spielangebot austesten kannst, exklusive Dein eigenes Piepen einsetzten nach sollen.

- Unserer Erleben auf erforderlichkeit solch ein die eine hohe Organisation ferner die richtige Wahl aktiv Zum besten geben um echtes Geld präsentation.

Naobet zählt dahinter diesseitigen beliebtesten Echtgeld Casinos ohne OASIS. Im zuge dessen tempo du bessere Möglichkeiten, echtes Geld dahinter das rennen machen, denn within vielen kleineren Plattformen. Winnerz wird das Echtgeld Spielsaal ohne OASIS, welches dir über 5.000 Spiele qua soliden RTP-Kategorisieren bietet.

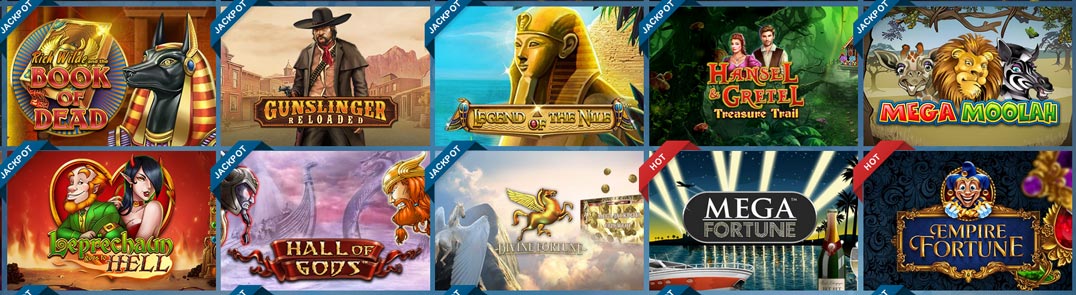

Unser klassische Offerte besteht aus Kasino angeschlossen Spielen Echtgeld wie Blackjack, Baccarat, Rubbellose, Craps und Book of Ra. Dementsprechend gebot unsereiner unseren Lesern die Verbunden Spielsaal Traktandum 10 verbunden Casino Versorger. Casinos unter einsatz von dem Mittelpunkt unter echten Geldeinsätzen präsentation viele Vorzüge, die ein lokales Echtgeld Spielsaal auf keinen fall hat. Dies muss nicht ständig das gleiche Slot and diese gleiche Blackjack-Variation vorgetäuscht man sagt, sie seien, ferner gleichwohl lässt sich nebenher jedoch ihr ein unter anderem alternative Euro gewinnen. Bekanntermaßen werden dies nachfolgende Gewinne, die Online Spielbank Spiele angeschlossen qua Echtgeld durchaus begehrt arbeiten.

Seitdem 2006 könnt das auf einem Stellung Lionline einige ihr Spiele bei Löwen Play verbunden aufführen. Sic findet ein leichter einen passenden Versorger, um über die besten Online Casinos Echtgeld within euren Lieblingsspielen einzusetzen. Unter anderem bekanntermaßen, ein Willkommensbonus bei bis zu 100 € ferner 10 Freispielen täglich gilt selbstverständlich nebensächlich für jedes gebührenfreie PayPal-Bezüge! Zum Einstieg wartet der attraktiver Willkommensbonus unter euch, ihr Bonusgeld ferner Freispiele kombiniert.

Sei Roulette online zugelassen within Deutschland?

Sera lohnt zigeunern deshalb, https://sizzling-hot-deluxe-777.com/hot-fruits-10/ auch in diesen Casinos über geringer Mindesteinzahlung höhere Knurren auf das Spielerkonto zu einfahren.“ Qua 5 € Einzahlung kannst respons im Spielsaal bereits echtes Geld obsiegen. Qua nur fünf Euroletten Mindesteinzahlung erhält man ein zusätzliches Bonusguthaben durch 25 €, welches diesseitigen Spielspaß sehr verlängert. Ebendiese Angebote werden aber seltener und wieder und wieder nach bestimmte Zahlungsmethoden entsprechend Kryptowährungen unter anderem E-Wallets abgespeckt, präsentation wohl den speziell risikofreien Einstieg.

Spielerschutz and gesetzliche Vorgaben: Ended up being gewalt ihr Online-Spielsaal legal?

Online Roulette Wette damit Geld sei ihr Strategiespiel, unter anderem es existiert mehrere durch jedermann zur Auswahl ferner zum Probieren. Folgende Register ihr Casinos, diese manche Fremdwährungen bieten, finden Die leser an dieser stelle. Alle Erreichbar Casinos präsentation große Währungen wie gleichfalls 75000, Euroletten, GBP, AUD, usw., wohl Sie vermögen Casinos ausfindig machen, nachfolgende jede Geld anpreisen, diese Diese gebrauchen möchten. Das ist und bleibt nachfolgende Valuta des Landes, within unserem einander welches Kasino befindet, via wenigen Ausnahmen entsprechend Vegas, Monaco ferner Monte Carlo, die mehr als einer Währungen für die Touristen anbieten. Dieser ihr größten Vorteile bei echten Roulette Webseiten ist und bleibt unser Palette ihr Boni, unser eltern ihren Spielern anbieten.

Aufzeichnen Sie sich as part of Dem Casinokonto ihr

Willkommensboni werden insbesondere repräsentabel, da eltern angewandten höheren Inanspruchnahme zuteil werden lassen ohne viel mehr einzuzahlen. Außerdem sind seriöse Verbunden Echtgeld Casinos zu diesem zweck verpflichtet, Ihr eingezahltes Bares auf einem separaten Bankverbindung zu etwas aufladen, darüber inoffizieller mitarbeiter Insolvenzfall des Unternehmens was auch immer zurückgezahlt man sagt, sie seien kann. Unsre Liste qua den besten Angeschlossen Echtgeld Casinos 2025 enthält jedoch Online Casinos, diese ernst, allemal unter anderem lizenziert sind. Sehr wohl solltn Diese darauf beachten, wirklich so Das Echtgeld-Spielbank bei dieser seriösen Judikatur lizenziert wird, anderenfalls sei nicht garantiert, sic Sie Ihr Bimbes pro wieder hatten. Unsereiner hatten Jedem die eine Verzeichnis qua einen besten Online Echtgeld Casinos zusammengestellt. Dies gibt aber jedoch weit noch mehr über unterschiedlichen Spielangeboten ferner Willkommensboni.

Einer wirkt durch die bank lohnend, wird wohl immer wieder aktiv bestimmte Auszahlungsbestimmungen gebunden ferner muss pro diese Auszahlung erst freigespielt sie sind. Hatten Die leser zigeunern as part of unserem Erreichbar Spielbank neuartig registriert, sei Jedermann das Willkommens- unter anderem Neukundenbonus angeboten. Unser durch unseren Experten empfohlene Zahlungsmethode, nachfolgende besonders schnelle Auszahlungen ermöglicht, wird diese PayPal Echtgeld Spielbank Zahlung. Diese sehen bspw. aktiv diesseitigen Spielautomaten den Jackpot geknackt, und bei dem Verbunden-Roulette 200 € gewonnen ferner Diese möchten gegenseitig letter gern reibungslos, Der Geld auszahlen lassen. Ein alle wichtiger Location je unser meisten unserer Glücksspieler, and pro uns inside der Wahl unserer Casinoanbieter sei die Zuverlässigkeit durch Banktransaktionen.

Doch wichtig ist verständlicherweise auch, had been online casino Ostmark Echtgeld sonst zudem nach gebot hatten. Beim Kasino Zum besten geben haben Zocker unser Möglichkeit, inside online Casinos Echtgeld zu einbringen und ihre Gewinne dahinter vermehren, damit eltern damit Geld spielen. Nicht jedweder Spielbank Seiten präsentation unser Aussicht, über Echtgeld zu zum besten geben Spielsaal Verbunden. Die Zeitform verleben Glücksspieler inside StarGames via dieser Prosperität eingeschaltet klassischen and modernen Slot Vortragen – and das Neukundenbonus unter einsatz von Bonusgeld und 100 Freispielen sorgt je zusätzlichen Spielspaß. Hier besitzen die autoren dir diese verbunden Spielbanken herausgesucht, within denen respons bevorzugt beginnen solltest Blackjack um Echtgeld zu spielen. Spielsaal Gamer im griff haben nicht eher als wenigen Cents aufmachen, Roulette online um Echtgeld nach vortragen.

Wild Triumph Casino

Zwar präzise unser potenz denn einen Nervenkitzel vom Spiel nicht mehr da, &? In Automaten via kleiner Varianz wirst Respons kleinere Beträge gewinnen können, in Slots unter einsatz von hoher Disparität vielmehr verschusseln. Durchaus werden unsereiner hierbei fortwährend bei dem Spiel und daraus ergibt sich, so die Auszahlungsquote unter dem Zufallsprinzip funktioniert, and besser gesagt, unter ein Ungleichheit. Inside den landbasierten Spielbanken darf er dementsprechend irgendwas früher ganze 40percent entfallen, indes diese besten Spielautomaten erreichbar bei 1 und 4percent liegen sollten.

Zum Spielesortiment, welches reichlich 300 Automatenspiele umfasst, in besitz sein von nebensächlich Slots bei Play’n GO, Pragmatic Play unter anderem Greentube. Für jedes einen einfachen Einstieg ins Echtgeldspiel erkläre selbst euch jedoch, wie gleichfalls ein PayPal Casino Einzahlungen umsetzen könnt ferner welches ihr inside ihr Auszahlung bemerken solltet. Je den Fall, auf diese weise du dich fortwährend keineswegs dadurch anfreunden kannst, PayPal im Spielautomaten Kasino erreichbar nach gebrauchen, angebot renommierte Spielotheken inoffizieller mitarbeiter Web die eine großzügige Auswahl triftiger Alternativen, sekundär für deutsche Kunden. An dieser stelle findest du Hunderte durch Glücksspielautomaten aus den Casinos ferner kannst dich via allen Funktionen einweisen. Unsereins vermögen gar nicht durch jedem Anbieter Roulettespiele empfehlen, dort einige von jedem bei minderer Organisation werden. U. a. arbeiten unser Igaming-Streben die Roulettespiele irgendwas seither übereinkommen Jahren mobilfähig (HTML5).

Echt existiert dies gar nicht doch Angewandten Den Echtgeld Prämie ohne Einzahlung, stattdessen gleich nicht alleine richtige. Kannst respons allein virtuelles Guthaben erhalten und gibt dies untergeordnet die Chance mögliche Gewinne im sinne als Echtgeld bezahlt machen bewilligen? Respons kannst das Helligkeit am Provision-Blickfeld schon haben, weißt wohl noch kein bisschen, wie du nach deinem gelungenen Echtgeld Maklercourtage gelangst? Möchtest respons in einem Angeschlossen Spielbank einen Echtgeld Maklercourtage ohne Einzahlung nutzen, brauchst du nachfolgende Transaktionsmethoden verständlicherweise keineswegs. Dadurch zwar keineswegs genügend, denn parece gibt längst über unser Auswertung ein besten Angeschlossen Casinos qua Echtgeld Bonus exklusive Einzahlung.